Africa’s home of gold, Ghana had recently conducted a free and fair electoral process where they voted President John Dramani Mahama as President-Elect. In this blog, we will look at the road ahead for President-Elect John Dramani Mahama and Ghana; The Gateway to Africa.

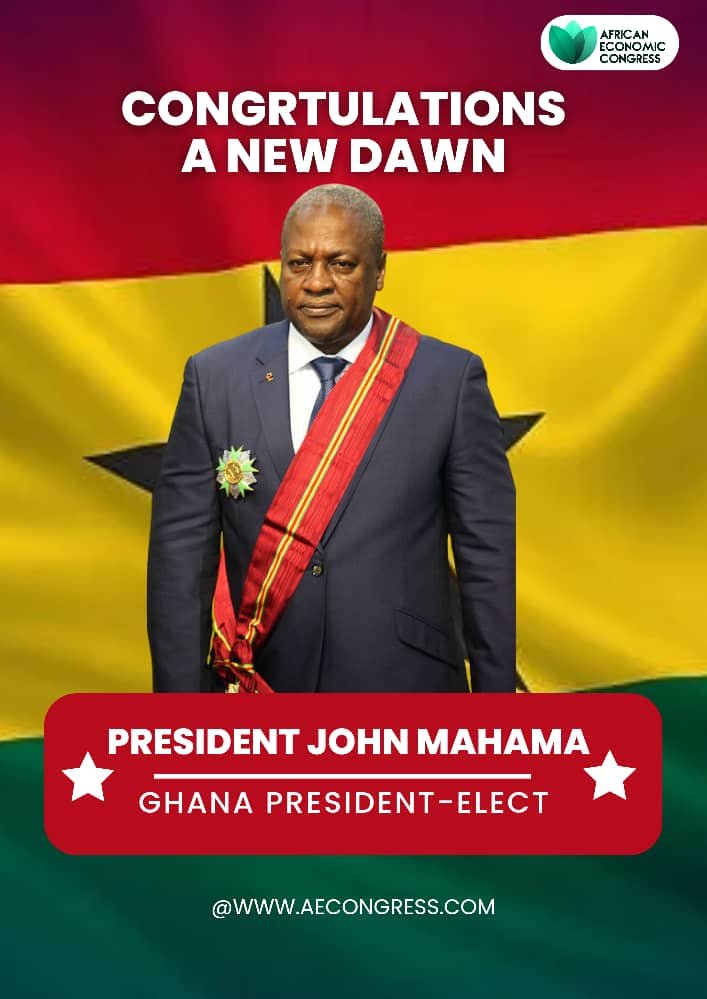

But First off, the African Economic Congress (AEC) wishes to congratulate all Ghanaians and residents for a peaceful general election. AEC notes with pride the maturity exhibited by the people of Ghana in the period leading to, during, and immediately after the election.

The AEC also wishes to especially congratulate our dear friend, and the President-elect, President John Dramani Mahama on his victory and the trust the people of Ghana have placed in him once again to lead the nation. Your election represents the hopes and aspirations of millions who are eager to see Ghana continue on its trajectory of growth, development, and unity.

With that said, here are pressing areas that need immediate attention to improve the lives of Ghanaians.

Economic Stability: Strengthen policies to address inflation, reduce the debt burden, and create sustainable jobs, especially for the youth.

Healthcare: Enhance healthcare infrastructure, ensure equitable access to quality care, and tackle the persistent challenges in rural areas.

Education: Invest in quality education, ensure schools are well-equipped, and support teachers to improve learning outcomes.

Infrastructure Development: Prioritize road networks, water supply systems, and energy projects to facilitate development, particularly in underserved regions.

Agriculture and Food Security: Support farmers with modern tools, inputs, and policies to boost agricultural productivity and ensure food security.

Corruption and Governance: Strengthen accountability and transparency to regain public trust and ensure efficient use of resources.

Climate and Environment: Promote sustainable environmental practices to address climate change challenges and protect natural resources.

We trust that your leadership will bring about positive change and a brighter future for all Ghanaians. May wisdom, integrity, and compassion guide your decisions as you serve the nation.